A cultural change was years in the making.

April 20, 2021 by Charlie Eisenhood in Analysis with 0 comments

In 2017, Discraft was in a rut.

In February of that year, they had made a nice splash by signing Valarie Jenkins Doss after she abruptly left Innova, but she and her long-time Discraft-sponsored husband Nate Doss were in the waning stages of their disc golf careers as they prepared to open a brewery in Bend, Oregon.

At the time, the Dosses were two of just four players on Discraft’s Elite Team, alongside Tim Barham and Michael Johansen. Meanwhile, other disc companies were making waves: Dynamic Discs signed Paige Pierce and Zach Melton, and Innova signed Eveliina Salonen and Jeremy Koling in the winter before the 2017 season.

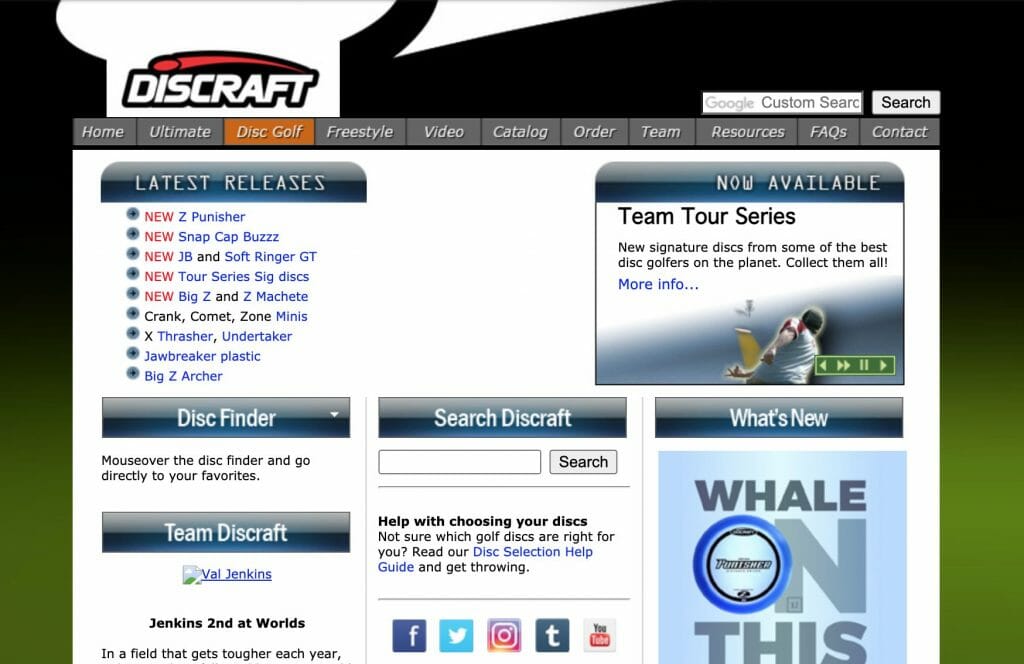

Nobody was talking about Discraft, and their website was a relic:

It’s not that people didn’t buy Discraft discs — they had a reputation for making the best midrange discs in the game — but there was a real sense of stagnancy permeating the brand.

“The other day someone on the course said to me, ‘No one knows what discs Discraft makes, but everyone has a Buzzz,'” said one Redditor in 2017.

“I just don’t understand their strategy. It really baffles me. Discs aren’t selling, fine, discontinue those that aren’t. But while every other company is continuing to develop better plastic types and new technology, Discraft just seems to be stuck on stupid. I get that their molds are pretty consistent, and I’ve certainly bagged my fair share of their discs, but it just seems like they are standing on the shore while the boat slowly drifts by,” said another.

Fast forward to 2021 and Discraft is arguably the sport’s hottest brand. The company just announced a 10-year, $10 million sponsorship contract extension with their biggest star, Paul McBeth. Paige Pierce and Brodie Smith are on multi-year deals and driving Discraft’s popularity and visibility. Hailey King and Adam Hammes are some of the most promising young talents in the sport. One of the biggest offseason sponsorship targets — Ezra Aderhold — had his selection of companies and chose Discraft.

The culture has changed, but it didn’t happen overnight.

***

In some ways, Discraft’s marketing had never really recovered from the 2012 offseason. Prodigy raided the cupboard of the legacy manufacturers by offering far more value to the players for signing endorsement contracts than was customary at the time, and Dynamic Discs started selling discs and signing exclusive sponsorship deals.

In 2012, Discraft’s Elite Team included Jeremy Koling, Cale Leiviska, Eric McCabe, and Devan Owens, and their Women’s Team featured Catrina Allen, Paige Pierce, Sarah Hokom, and Paige Bjerkaas (now Shue). In 2013, all of those players were gone, mostly to Prodigy. Their MPO Elite Team had dwindled to just Doss and Johansen.

In the court of public opinion, Discraft’s cachet fell off a cliff. As with any big player sponsorship swings, though, public perception outpaced the reality of actual sales. “We had one of our best years when we lost the team and people thought we were going the opposite way,” said Bob Julio, the Discraft Team Manager who’s been with the company since 2008.

Julio got his start at the Michigan manufacturer after frequenting a private disc golf course owned and designed by Jim Kenner, the founder of Discraft. “I actually was hired to help in shipping but my first day realized I was the only shipper,” he said. “It was very Mom and Pop back then.”

“I remember I asked how we kept track of inventory. And they said, ‘If you see a disc, we have inventory.'”

For years, Julio was the only serious disc golfer at the company, which more heavily emphasized its presence in ultimate frisbee, where the Discraft Ultrastar has long enjoyed a near-monopoly in the competitive game. Although he had ideas about how to develop their disc golf business, he was still just working in the shipping department.

But when the team cratered in 2013, he moved into a role focused specifically on disc golf. “It was a good time to have a fresh start,” he said.

In a way, Julio saw the Prodigy exodus as a blessing in disguise. The increased competition meant that Discraft would have to rethink aspects of their operations. “It gave me a lot of leverage for things I was complaining about behind the scenes,” he said.

Discraft was in the starting stages of a multi-year transitional period. Mike Wagner, today the Chief Operating Officer, was taking on increasing responsibilities for day-to-day management. Julio started a custom stamp program for disc golf and started to push Discraft into more sponsorship, including with the Ledgestone Insurance Open and Green Mountain Championships. Later, they got involved with the Disc Golf Pro Tour.

Meanwhile, Discraft was focused on infrastructure: establishing a new warehouse, adding injection molding machines, and preparing for the future. What they weren’t doing was signing players to sponsorship deals.

“The rule was, ‘We don’t sign anyone who’s not a hardcore Discraft thrower already,'” said Julio.

The late Brian Sullivan, a disc golf media pioneer and Discraft’s head of marketing for almost two decades, gave an interview in August 2017 that highlighted some of the thinking at Discraft at the time:

Discraft, led by Jim Kenner, has been using science and engineering since the 1970s to study the physics of flight and evolve the flying disc into what it is today. This fact — along with high manufacturing standards — is what puts consistency as the number one reason why Discraft is valued by our customers and what sets us apart. We understand how to make a quality flying disc, and how to manufacture it to be consistent from run to run, year after year.

The downside of this commitment to science-based manufacturing has been showing in recent years, and frankly we’re frustrated by it: Joe and Jill Teepad in the general marketplace don’t necessarily care. So while much of our spending goes into development and testing equipment, R&D using highly educated professional employees and manufacturing with a US workforce and production costs, many of the new disc companies are able to cut out the majority of these costs by copying molds and manufacturing overseas. They charge just as much for their discs as Discraft does, giving them much larger discretionary budgets that can be used for marketing, high profile pro player sponsorships, and development of every accessory known to disc golf (also all manufactured overseas, of course). We have certainly come to understand how music legends were feeling when the era of music sampling began and suddenly their work was being used to turn relative hacks into stars.

But there is an upside to this for us. Having been around as long as we have, it’s been all about slow and steady growth. As a result, we have no debt. We own our buildings, we own our machines, we don’t have to take out a loan when it’s time to order more plastic or invest in new technology. I can’t image how the accountants at some of these newcomers are getting any sleep, staring up at mountains of debt, because there is no way their income is even remotely matching their spending. One ugly lawsuit, one weak insurance policy or one bad public relations blunder and (snaps his fingers), they’re gone, bankrupt. Jim Kenner built Discraft on a rock, we can weather any storm.

Sullivan’s frustration with disc golf competitors also showed up in his answer about player sponsorships:

Today, the industry has entered what I call the gunslinger era of player sponsorship, when players are jumping from brand to brand every year or two. Bigger money sponsorships don’t buy loyalty to a brand and don’t buy success for a brand. When Prodigy first appeared, they paid relatively big bucks to lure many of our top players away who then helped to promote that new brand. And yes, they got a lot of attention from it and a lot of players tried Prodigy discs, but many found the plastic to be wildly inconsistent. Two years later they were a mess, and most of the players bailed when their contracts were done.

We were talking recently with a high profile player who told us that he expected his sponsor to help build his personal brand. We understand that it is very difficult to make a living as a professional disc golfer, but that is the statement of a gunslinger. We politely declined to offer a sponsorship.

At this point Discraft is still focused on building our team as a family. New additions need to demonstrate that they are already passionate about the quality and performance of our discs. We know how much (or how little) overall industry sales are, and have no intention of getting into bidding wars for two year contracts with certain top-rated pros who will simply start the bidding again at the contract’s conclusion. But we are glad that many of our competitors are willing to do so, because the debt they are racking up isn’t sustainable, and Discraft has every intention of being around for the next 40 years.

And since the growth of the sport was pushing sales higher, why fix what’s not broken? Losing most of the team in 2013 hadn’t hurt their business.

“It made my job harder in some sense: I wasn’t bringing any data in that showed that we needed to get better players on the team,” said Julio.

***

In April 2018, Jon Richardson–the founder of Upper Park Designs, a disc golf bag company–joined Discraft as their new Marketing Director1. The company had just rolled out a much-improved redesign of its website and recognized that it needed to modernize.

“Being in business for 40 years, there’s going to be times where you get behind the times and you have to take it to the next level,” said Julio.

“I started digging into their website and their YouTube and their presence in general, and I said, ‘There’s a lot that could be done here,'” recalled Richardson, who said that he saw the brand as “outdated.”

Richardson was one of a number of new disc golfers that had joined Discraft as employees; Julio could feel the winds shifting.

“I fought tooth and nail for years [on changes],” said Julio. “And it kind of felt like I was on my own a lot of the time…The energy here for disc golf got a lot more excitable.”

Julio knew that the goal was to reemerge with new sponsored players alongside a new Star Wars licensing deal and some swirly plastic innovations. And an enormous opportunity had presented itself.

Paul McBeth was looking to talk.

***

“All I ever knew and saw was Innova,” said Paul McBeth, who grew up in southern California, outside of Los Angeles.

McBeth’s first exposure to Discraft came at Junior Worlds in 2005, a tournament sponsored by Discraft. There, he picked up a Buzzz for the first time. It was the only Discraft disc he threw besides “maybe Magnets. I think I putted with Magnets, because Steve Rico putted with Magnets.”

McBeth signed a sponsorship deal with Innova in 2005, where he remained until 2018. Through those 14 years, he watched from the outside as Discraft’s team swelled — “a lot of the cool kids back then were throwing Discraft,” like Paul Ulibarri — and then shrank — “Discraft had Nate Doss and that was it. That was literally it. They had MJ but MJ doesn’t travel.”

As Prodigy and Dynamic Discs became the buzzy brands in the early 2010s, Innova still held strong as the biggest company with the best sponsored players.

“[Discraft] was a pretty far afterthought, and they weren’t doing anything to change,” said McBeth. “And they weren’t trying to do anything to change.”

But as the company prepared to revise its marketing strategy, Nate Heinold, long affiliated with Discraft and a friend of McBeth’s, put a bug in his ear about maybe switching sponsors. McBeth’s contract with Innova was expiring at the end of 2018, and Discraft was starting to think about getting back into the serious sponsorship arena. Heinold helped broker a meeting.

Julio had known McBeth for years at that point. They weren’t friends, really, but they shared some repartee — McBeth would furtively put an Innova magnet on Discraft’s truck and Julio would retaliate by putting Discraft stickers on the Innova logos on his RV. When Julio heard from Heinold that McBeth wanted to talk, he assumed it was just a leverage play.

“I called Paul and said, ‘Hey, if you’re just trying to get more money [from Innova], just let me know now,'” he said. But McBeth insisted that he was serious about considering Discraft.

“I was one of the first people that [McBeth] told that he was thinking about Discraft,” said Jeff Korns, now Discraft’s Tour Manager who at the time worked for Discmania. “And I was like, ‘That’s funny.’ I’d seen the commercials of him saying he never saw himself throwing anything but Innova.”

Julio knew this was a huge opportunity, but the company had been reluctant to do big ticket sponsorship deals for years. Spending an unprecedented amount of money on a contract for just one player? “There’s no way we’re just going to hand over money,” said Julio. “How can I convince Mike [Wagner] that this would work?”

On the back of a napkin, Julio wrote down five molds and started to sketch out a plan for how marketing McBeth discs could work. He went over to Wagner’s house that night — August 14, 2018 — at 11 PM. “He’s the numbers guy,” said Julio. “He’s backing up what I’m saying. In my head, I’m like, ‘This might actually work.'”

The two sides didn’t talk about money for weeks — just a framework for how to promote McBeth. Concerns about emphasizing the player above the company were dissipating.

“We can offer you something that no one’s really done,” Richardson told McBeth. “We can offer you a brand.”

***

While the disc golf and marketing teams saw the potential of a blockbuster signing, the business side remained skeptical. Wagner was uncertain at first, and Kenner, the final decision maker, was initially against the idea.

“Jim was never wanting to grow,” said Julio. “He was always very strict on quality…It was kind of hard to convince Jim at first.”

But change within Discraft was afoot. Richardson was pushing for a new marketing approach, one predicated on highlighting players as a way to sell plastic, rather than plastic to sell players.

“Nobody was ever knocking their plastic — they have the most consistent plastic — but it just wasn’t what the people were looking for,” said McBeth.

Pressing the issue was the fact that Nate and Valarie Doss were retiring from competitive disc golf. They needed a new star.

Understandably, McBeth wanted a guarantee that he would make as much as he had been earning with his Innova deal. Committing to a significant salary — $250,000 a year — was scary, even if it looked like the numbers were going to make sense.

“It gets down to the point where Jim’s hangup was that [Paul’s] throwing old Innova stuff that’s not replaceable,” said Julio. McBeth always carried a lot of weathered discs, including multiple Destroyers in various stages of wear. But McBeth had made clear that he liked the Discraft discs and wasn’t worried about switching his bag.

“When he bought into that, we knew we were golden,” said Julio.

***

On November 19, 2018, Discraft announced that they had signed a four-year sponsorship deal with Paul McBeth. The details of the contract, worth over $1 million in guarantees and far more by now thanks to disc sales commissions, were negotiated by an agent working on behalf of McBeth.

“I guess it was a little bit of a gamble from the outside, but, to me, it was never a gamble,” said Julio. “We were confident that if people gave us a chance, they would like it.”

Any nerves around committing that much upfront money went away within three months. Discs were flying off the shelves. The decision to create a line of discs specifically for McBeth was an almost immediate home run — the Luna, a putter built to McBeth’s specifications, proved wildly popular and even a year after its release is the top-selling putter at Infinite Discs, the sport’s biggest online retailer.

“It’s not just a sponsorship; it’s more of a partnership,” said McBeth. “In order for myself to succeed, they need to succeed and vice versa.”

The $250,000 a year floor was hardly relevant: McBeth earned about four times that much in his first year with Discraft after sales commissions. And of course Discraft was reaping the rewards as well.

So how do follow up on such a blockbuster signing? You double down.

“Jim comes to me and says, ‘Why don’t we have Paige?'” said Julio. “He was always a huge fan of Paige. He said, ‘We’ve got the best male in the sport — why don’t we have the best female?'”

***

One year later, Discraft signed Paige Pierce to a multiyear deal.

Pierce had started her professional career sponsored by Discraft. In her first full touring season in 2010, she finished seventh at the Carolina Clash, a National Tour event, and followed it up with a second place finish at the Beaver State Fling. Discraft didn’t hesitate to offer her a sponsorship.

That’s where she remained the next two and half years. After 2011 Pro Worlds, her first major championship win, she was invited to stop by the Discraft warehouse and pick out as many discs as she liked. Pierce said she probably got 500 discs, and Discraft also reimbursed all of her entry fees for tournaments she entered that season. “It just spoke volumes to me that they were willing to do so much and show their commitment to me moving forward,” she said.

Despite the gesture, she walked away from Discraft at the end of 2012 as part of the mass exodus to Prodigy. The money was that much better.

But that relationship soured just a few years later, and rumors swirled about Pierce making a move to Dynamic Discs. She joined the brand in the beginning of 2017 before agreeing to a three-year extension after the 2018 season. A year later, however, Pierce and DD terminated their agreement just weeks before she was announced as the latest Discraft signing.

“I told Bob Julio, ‘In hindsight, I would have never left,'” said Pierce. “He said, ‘I think it’s good you did what you did, because Prodigy set the stage for how professional disc golfers should be paid.'”

“She always felt like family to us,” said Julio. “We knew why she went to Prodigy. She left on good terms. We knew why she went to Dynamic.”

Pierce, too, mentioned the family atmosphere. “To be honest, I was very surprised at how many people were still there that I remembered,” she said.

Learning from the McBeth deal, Discraft pushed Pierce’s personal brand, designing a new PP logo and rolling out a putter, the Fierce, that she helped create. More than twice as many people bought Fierces on the first drop than initially bought Lunas.

“We wanted to market her to everyone,” said Julio. “We wanted men to wear her hat; we wanted women to wear her hat.”

Pierce continued to dominate the FPO field in her first year with Discraft, pushing her rating to 991, by far the highest number ever for a female disc golfer.

***

Discraft’s addition of Brodie Smith, whose social media reach extends far beyond any elite disc golfer’s, was the final piece of the puzzle. Smith’s influence with new players is undeniable; he spent years driving people into trying ultimate frisbee.

“It’s hard to compare him to Paul and Paige, but compared to a new player coming into the sport, I’ve never seen anything like this,” said Julio. Given that the significant majority of disc sales come from new or beginner players, Smith’s appeal to a disc company is obvious. Discraft just re-signed him to a two-year deal over the winter.

But the real signal of just how much Discraft has shifted their strategy — and been rewarded for it — is February’s announcement of Paul McBeth’s $10 million deal. The long-term commitment was sought by Discraft, not McBeth, as they looked to solidify the arrangement for the long-term in order to feel comfortable committing to more capital expenditure.

Originally, Discraft floated the idea of a four-year extension, but McBeth didn’t want to have to earn a new deal in his mid-30s. “That’s the worst time to have to do a contract negotiation,” he said.

Discraft was so confident that they would come to terms, though, that they went ahead with an order of new injection molding machines. “At that point, I felt like I had a little bit of leverage,” said McBeth. “But I didn’t need it. They came with an incredible offer.”

The new deal sets a guaranteed $1 million a year floor, but McBeth still has further upside with commissions if disc sales continue to grow. The contract also makes the economics of selling McBeth line discs, like the Luna, more favorable for Discraft.

“Now that we’ve restructured the deal, they’re not worried about running Paul McBeth Zeuses for a month straight,” said McBeth. “We’re in it together.”

Discraft’s biggest challenge at the moment is meeting a surge in demand. “The growth trajectory we were already on, combined with COVID, combined with the players: it was like a perfect storm,” said Richardson.

The custom discs program has been shuttered for months, and retailers can’t request specific discs, weights, or colors right now — they have to just take what Discraft sends them. Retailers, particularly smaller ones, are not happy, and many molds are out of stock at even the biggest retailers.

In a way, they have become a victim of their own success — and expectations are rising. Growth problems, though, are a lot better than the alternative.

“We know that we’re going to keep doing this — we’re going to be here for a long time,” said McBeth. “Let’s just be ready to make the next move.”

Want more long-form writing like this? Become an Ultiworld Disc Golf subscriber to support our work.

he has since left the company ↩