What does data about non-sanctioned events, or those sanctioned by other governing bodies, reveal about the sport's growth?

June 16, 2017 by Josh Woods in Analysis with 0 comments

Every kid has at least one completely ridiculous belief that causes embarrassment later in life. Mine was the Smurfs. For a time, I was sure they were real. One day I even went looking for them in a forest near my house.

After spending half the day turning over rocks and kicking tree stumps, I came to three conclusions. One, Smurfs probably do not exist. Two, throwing stones at a hornet’s nest is a bad idea (really, don’t do that). And three, nothing exists until it’s observed.

Many years later, the third lesson served me well as I went looking for another mythical woodland creature: the unsanctioned disc golfer. Much is known about the members of the Professional Disc Golf Association (PDGA). We have statistics galore on the number, size, location, and winners of PDGA-sanctioned events, but little is known about non-PDGA tournaments.

Although much of this mystery remains, I recently stumbled upon an interesting set of clues. Given new developments in technology, disc golfers are now registering for both PDGA and non-PDGA events online. Disc Golf Scene (DGS) and Disc Golf United (DGU), the two largest companies that offer online tournament registration, have recorded thousands of events that do not appear in the PDGA’s demographic reports.

These stats, which were kindly provided by Peter Crist from DGS and Adrian Southern from DGU, may hold answers to two important questions. First, how much non-PDGA activity is out there? And second, do PDGA events accurately reflect differences in disc golf activity across states?

How much non-PDGA activity is out there?

Over a two-year period (2015-2016), the PDGA sanctioned 4,367 tournaments and leagues in the United States.1 DGS and DGU registered an additional 3,615 non-PDGA tournaments over the same period.

There are other online platforms that provide tournament registration, but including these would probably not increase the non-PDGA count significantly. For instance, in late May 2017, 4DiscGolf.com listed thirteen PDGA-sanctioned tournaments and five non-sanctioned events; IregisteredOnline.com listed two PDGA events.

Many small-scale tournaments and charity events are organized through word-of-mouth, email lists, Facebook groups, and day-of-only registrations. These events are not included in the DGS/DGU counts. As DGU’s Director Adrian Southern put it, “My sense is that there are quite a few smaller, grassroots events that still do things day-of. If I had to take a wild guess, I would say 200-300-plus use no form of pre-registration each year.”

Southern’s guess may be about right. As I looked through the registration formats of numerous small events, such as Discraft Ace Races, Trilogy Challenges, and Ice Bowls, I found that many were non-sanctioned and offered same-day registration only. My tabulations were small and non-scientific, but I would bet, with reasonable confidence, that about 30-45 percent of small, non-PDGA tournaments have day-of-only registrations. That amounts to somewhere around 250 to 400 events per year added to the total non-PDGA count.

Combining the counts from DGS and DGU and adding 300 day-of registration events per year puts the final estimate of non-PDGA tournaments in the U.S. at 4,215 in 2015-2016. In short, non-PDGA disc golf is indeed real.

Do PDGA events accurately reflect differences in disc golf activity across states?

Looking deeper into the DGS/DGU data, I found that non-PDGA events are not evenly dispersed across the country. But why does such variance exist? One theory suggests that differences in the number of non-PDGA events by state merely reflect the differing roles of the PDGA in each state. Alternative organizing bodies may be highly active in some regions, which would diminish their number of PDGA events and increase their number of non-PDGA events.

This is a provocative theory, because it suggests that disc golf communities that are well-organized at the local level may be less recognized at the national level, given the wide availability of PDGA statistics. The theory also suggests that both PDGA events and non-PDGA events, if considered alone, are poor indicators of a state’s overall disc golf activity. Depending on the level of organizational competition in the given region, a state may have a high ranking on one measure and a low ranking on the other.

Consider, for instance, the organizing efforts of the Southern Nationals (SN), a regional sanctioning body and popular tournament series. The presence of the SN in the south may explain why some southern states have fewer PDGA tournaments (and more non-PDGA tournaments) than some northern states.

SN Board Member Casey Cox offered insights into the organization’s scope. Most events take place in Mississippi, Louisiana, and other southern enclaves like Memphis, Tennessee; Mobile, Alabama; and Pensacola, Florida. SN typically sanctions between 100 and 120 events per year.

“There are definitely plenty of organized tournaments that are not PDGA-sanctioned, and most are just the same as any C- or even B-tier PDGA event that you would attend,” Cox said.

“The SN is a true player-driven, player-run volunteer organization that returns almost all sanctioning fees to the players,” SN Board Member Michel Munn added.

For many years, the SN Series was living off the PDGA grid, but that seems to be changing. “The number of SN events dual-sanctioned with the PDGA was very low in the past, but has definitely increased in recent years,” Cox said.

The SN is not the only well-organized regional player. It is possible that PDGA event statistics understate disc golf activity in several states where local disc golf organizations are especially active.

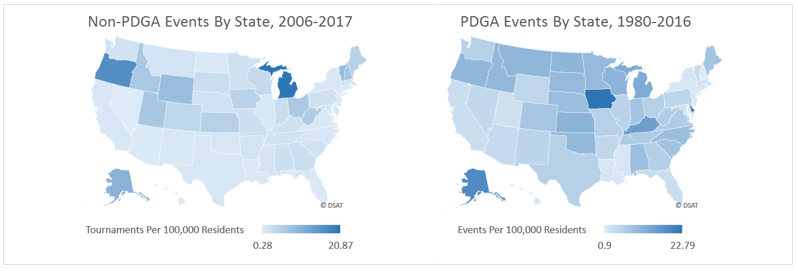

To test this assumption — let’s call it the PDGA deflation theory — I mapped both PDGA events and non-PDGA events by state.2 For the PDGA map, I used all-time PDGA events data, while the non-PDGA map is based on all the available data from DGS and DGU (DGU provided data from 2015-2016; DGS offered data going back to 2006). All measures are based on the number of events per 100,000 residents in the state.

If PDGA deflation theory holds, the shading of the two maps should reveal an inverse relationship. In other words, the dark blue states in one map should change to pale white states in the other. As shown in the maps below, however, the results offer little support for PDGA deflation theory. Much of the South and Southwest are pale or light blue in both maps, while much of the Midwest and Northwest are light blue or blue in both maps. Eleven of the top 20 PDGA states are also top 20 non-PDGA states, and 14 of the bottom 20 PDGA states are also bottom 20 non-PDGA states.

There are, of course, exceptions, and some states deserve further attention. For instance, Vermont and New Hampshire are located within the territory of the New England Flying Disc Association, and both states are notably low in PDGA events and quite high in non-PDGA events. Still, overall, the analysis generally rejects PDGA deflation theory.

A more precise test involves computing the correlation between PDGA events and non-PDGA events using states as units of analysis. If some states are PDGA-centric, while others rely on regional bodies, there should be a negative correlation between the two variables.

As it turns out, there is a positive correlation (r = .303) between PDGA events and non-PDGA events. That is, states with lots of PDGA events per capita tend to have lots of non-PDGA events per capita, and vice versa. The number of non-PDGA events is also positively correlated with PDGA memberships per capita (r = .460) and disc golf courses per capita (r = .307), further suggesting that other factors, besides inter-organizational conflict, explain the level of disc golf activity by state. In short, anti-PDGA enclaves may exist, but not in large numbers.

This study may seem esoteric to some people. But systematic observation of disc golf activity may help decision-makers within the disc golf community grow the sport. Evidence-based claims are also the key to persuading public officials that disc golf is growing in popularity and contributes to the well-being of local communities. If we don’t observe it, write about it, film it, and analyze it, disc golf does not exist. Consider supporting disc golf research by following Parked: A Disc Golf Think Tank.